Andi Ardianzah

(46110008)

What is Financial Statement Analysis?

The process of understanding the risk

and profitability of a company through analysis of reported financial

information

financial

statement analysis is useful in making business decisions made by financial

managers, such as whether to invest in equity or debt securities, whether to

add credit through short-term loans or long term, and many other business decisions.

Financial statement analysis is not only useful for fund managers but also all

interested parties (stakeholders) in the company.

Scope of Financial Statement Analysis

The Main Aspects

•

Liquidity

analysis

Liquidity analysis is an analysis of the short-term perspective. In general, liquidity analysis is an analysis of the company's ability to repay its short-term liabilities

•

Solvency

analysis

Solvency analysis is an analysis of the long-term perspective. In general, solvency analysis is an analysis of the company's ability to pay off all of its

liabilities, both short term and long term

•

Profitability

analysis

Profitability analysis is usually called the profitability analysis is an analysis of the company's ability to earn income, either by sale or by investment

•

Cash

flows analysis

cash flow analysis is an analysis of cash inflows and cash outflow. On this analysis will be described about where the sources of cash acquired companies and where cash is used by the company.

Other Aspects

•

Bankruptcy

prediction analysis

banckruptcy prediction analysis is an analysis that can help companies to anticipate the possibility of the company going bankrupt due to financial problems

•

Risk

analysis

risk analysis is an analysis of the

risks faced by the company that would cause the company's financial

difficulties

•

Investments

analysis

investment analysis is an analysis of

the company's investment plan in the form of securities. On this analysis will

be discussed about investing in bonds and common stock

Earning Per Share

EPS is the company's profitability level analysis tool by evaluating common

stock

EPS or earnings per share is the net profit level for each share, a company that is able to be achieved during the course of operation. Earnings per share or EPS obtained from earnings available to common stockholders divided by the weighted - average common shares outstanding.

One reason investors buy stocks is to get the dividend, if the value of earnings per share less the smaller the company the possibility to distribute dividends. It can be said investors will be more interested in stocks that have high earnings per share compared to stocks that have low earnings per share. Earnings per share are low tend to make stock prices go down.

EPS or earnings per share is the net profit level for each share, a company that is able to be achieved during the course of operation. Earnings per share or EPS obtained from earnings available to common stockholders divided by the weighted - average common shares outstanding.

One reason investors buy stocks is to get the dividend, if the value of earnings per share less the smaller the company the possibility to distribute dividends. It can be said investors will be more interested in stocks that have high earnings per share compared to stocks that have low earnings per share. Earnings per share are low tend to make stock prices go down.

The Formula of EPS

the calculation of EPS is the amount of income earned

in one period for each of the outstanding shares, and will be used by

management to determine the amount of dividends to be distributed.

Example :

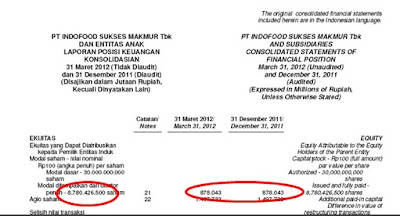

The Shares

of PT Indofood Sukses Makmur Tbk on 2011 and 2012 is 878.043 and the par value

is Rp 100

the weighted

averaged number of shares outstanding is 8780,43

Net income

on 2012 is Rp 815.02

the Earning

per Share ratio of PT Indofood Sukses Makmur Tbk on 2012 is Rp 92,8

Conclusion:

The EPS

Ratio of PT Indofood Sukses Makmur Tbk means that every shares of the common

stock earns Rp 92,8 of net income. This Ratio indicated the company have a very

high level profitability on common stock